Your Questions!

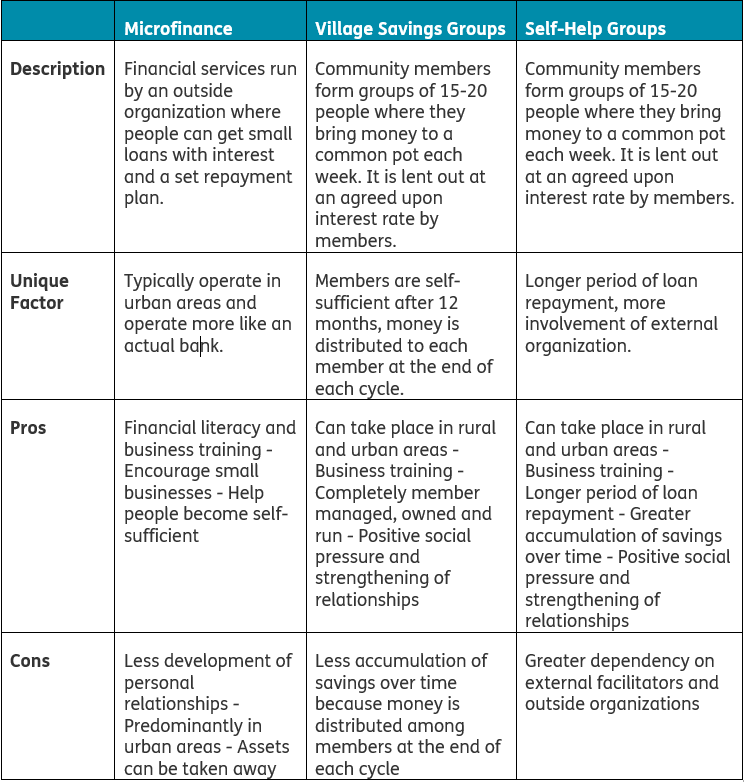

Village Savings and Loans vs Self Help Groups vs Microfinance

The lack of banking services in rural areas of developing countries make it difficult for the poor to start new businesses, replace broken farm equipment, or survive in times of crisis.

In desperation, they are forced to seek out loan sharks, who charge exploitative interest rates which perpetuate the cycle of poverty. This reality has resulted in the creation of various alternative financial programs for people to escape long-term debt.

1. Microfinance.

Microfinance refers to financial services such as loans, insurance, savings and money transfers. These programs are usually run by an outside organization with outside funding where people can get small loans with interest and a set repayment plan. Generally, microfinance programs offer financial literacy and business training.

Generally speaking, microfinance institutions typically operate in urban areas and perform best when providing credit to entrepreneurs with established businesses. The amounts loaned are generally a bit larger and interest rates are high – anyhere from a few dozen to a couple hundred percent. Because of this, microfinance is better suited to people who have a bit of money already and does not serve the bottom of the pyramid.

Additionally, there is no aspect of personal relationships because microfinance institutions operate more like an actual bank.

2. Village Savings Groups

In Village Savings and Loans Groups, people mobilize their own money. Community members form groups of 15-20 people where they bring micro amounts of money every week to a common pot so it is able to grow. It is then lent out at an agreed upon interest rate by the members. They can take place in both urban and remote, rural areas.

Like microfinance programs, these groups also include business training. Group members receive mentoring and training for 12 months, after which the goal is to be self-sufficient. All of the group’s money is distributed to group members after the end of an agreed upon cycle, generally ranging from 6-12 months.

The groups are completely member owned, run and managed. If a member defaults from the agreed upon rules, the members decide for themselves how best to handle the situation. For example, they could give the member an extension or help them to repay the loan.

These groups create community and trust and a high level of positive social pressure. People can make their own decisions with their own money while building relationships in their communities.

3. Self Help Groups

Self Help group are similar to VSL Groups. The main difference is that Self-Help Groups do not have as rigorous cycles as VSL Groups. They have a longer period of loan repayment and a greater accumulation of savings because they do not distribute the money to each member at the end of each cycle.

Unlike VSL groups, Self Help groups can get external injections of money from the NGO that help them get started and are more dependent on the external facilitators. Similar to VSL groups, members are empowered to make their own decisions and use their own resources, while building relationships.